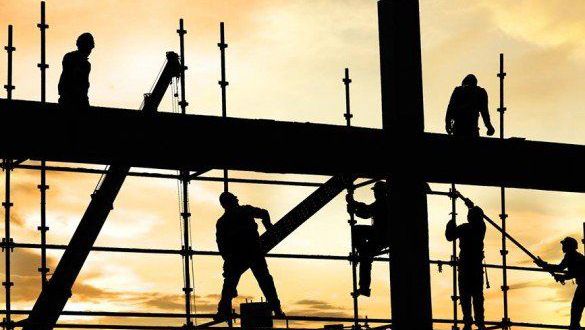

Construction Industry in Africa Bounces Back

The face of the African construction industry is changing. Construction projects on the continent are getting bigger and more complex. According to recent reports, this is owing to rapid urbanisation, strong economic growth, a rising middle class and regional integration in many of Africa’s 54 nations. All make for the ever-increasing demand in Africa’s construction industry, as big infrastructure projects get under way on the continent. This development leaves industry stakeholders with a lot of questions on how to best secure funding for a project, what is needed for successful project management, what projects have priority and how to access the African market place?

Construction costs will rise due to materials and labour

One of the most common concerns industry experts cited is the escalating cost of doing business. With rising building material and labour costs, firms will likely struggle to maintain their margins in the coming year.

One of the most common concerns industry experts cited is the escalating cost of doing business. With rising building material and labour costs, firms will likely struggle to maintain their margins in the coming year.

Contractors have been expecting an impending bump in building material costs after several years of relatively flat growth. The Associated Builders and Contractors called the most recent decline in material prices “the calm before the storm.”

On the labour side, the skilled-worker shortage has led to employers raising average pay higher than the national average. Experts say that increasing workforce costs — which include recruiting and wage costs for current employees — will cut into contractors’ bottom lines.

Most Africa countries spent a lot of money in the construction related projects in the last couple of years and growth of over 5% in the construction industry is expected in the next two years.

Demand for Green Cement in Africa

The global market for green cement is expected to grow to US$38.1 billion by 2024 from US$14.8 billion in 2015. Green cement reduces the carbon footprint of construction activities through the substitution of cementitious industrial wastes, such as fly ash from coal-fired power plants and slag from the steel and iron processing industry, as a replacement for traditional cement.

Demand for green cement in Africa will provide an increasingly lucrative market over the next few years due to growing trends in sustainability and energy efficiency for both buildings and infrastructure.

The coming years will witness an increase in demand from local African marketplaces for more sustainable products in the local built environment.

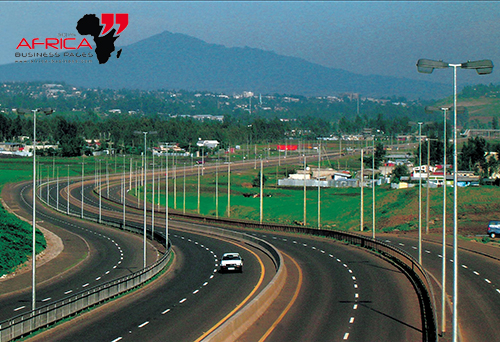

Kenya: A Booming Construction Industry

Currently, Kenya’s construction industry is going through boom. The government has invested heavily in the construction sector of Kenya in order to improve the infrastructure such as road networks, and at the same time provide new residencies for the locals (who are being supported by the banks to get loan to buy apartments/cars).

According to the Kenya National Bureau of Statistics, the real estate and construction sectors continues to be some of the key drivers of economic growth in Kenya for the last five years. The Kenyan construction industry contributes 7 percent of the gross domestic product (GDP), which makes it clear that Kenya has a well-developed construction industry. With an increase in population, opportunities exist in the construction of residential, commercial and industrial buildings, including prefabricated low-cost housing.

According to the Kenya National Bureau of Statistics, the real estate and construction sectors continues to be some of the key drivers of economic growth in Kenya for the last five years. The Kenyan construction industry contributes 7 percent of the gross domestic product (GDP), which makes it clear that Kenya has a well-developed construction industry. With an increase in population, opportunities exist in the construction of residential, commercial and industrial buildings, including prefabricated low-cost housing.

The economic outlook of the country indicates that the construction industry presents one of the key areas that would, and is, attracting investors to the country.

Extensive opportunities for investment exists particularly in the area of upgrading slums and informal settlements, urban renewal, construction of middle and low income housing, and the manufacture and supply of building materials and components.

Infrastructure development is a central pillar of Kenya's Vision 2030 and in 2015 the US$3bn construction sector contributed 4.8% to the Kenyan economy. The Economic Survey 2016 published by the Kenyan National Bureau of Statistics (KNBS) reported that approximately 148,000 people are formally employed in the domestic building and construction industry. Players operating in the sector range from indigenous micro-enterprises to foreign multinational civil engineering and construction giants. Although building and construction contractors are required to be registered with the National Construction Authority (NCA), a significant number of unregistered contractors operate in the informal sector.

Kenya has the highest literacy rate in Africa and the workforce is well known for being educated and hard working. One advantage for foreign investors is that everyone speaks the common language English. This makes it easy for new people to understand and quickly adapt to the new country.

Therefore, Kenya serves as a good starting point to begin business in Africa due its positive growing economy, natural reserves & a strong workforce who can easily be communicated with.

A recent study by BMI Research shows that the local construction industry will grow by 8.7 per cent this year and remain steady up until 2026 with an annual growth of 6.2 per cent – which will see Kenya outperforming all Sub-Saharan countries.

Kenya’s construction market is poised for significant expansion between 2018 and 2026. Significant support for the sector will stem from the Kenyan budget, backed by foreign investment into the country’s planned infrastructure development.

Nigeria's Construction Industry

Following a difficult 2016 the Nigerian construction sector showed signs of stronger growth from the first half of 2017 onwards. The uptick in activity comes on the back of a low base, however, as the country’s first recession in 25 years affected private investment in real estate building and oil companies had to scale back investment plans due to lower global oil prices.

The stabilisation of the naira, the utilisation of new contract structures and an increase in local suppliers are now helping to provide fertile ground for activity. Local content, in particular, is playing a larger role in the market, with domestic companies active as both standalone contractors and as subcontractors for foreign firms. While public sector tenders – which have traditionally been the source of major works – remain limited compared to the booming years of the 2000s, the increase of private development in the residential and commercial building segments offers promise.

The stabilisation of the naira, the utilisation of new contract structures and an increase in local suppliers are now helping to provide fertile ground for activity. Local content, in particular, is playing a larger role in the market, with domestic companies active as both standalone contractors and as subcontractors for foreign firms. While public sector tenders – which have traditionally been the source of major works – remain limited compared to the booming years of the 2000s, the increase of private development in the residential and commercial building segments offers promise.

Nigeria is often highlighted as one of the most attractive markets in Africa for construction works. In West Africa, of the nearly $120bn committed to infrastructure spending across 92 projects, 61% is earmarked for plans in Nigeria. The country currently has 68 major building projects with a total capital expenditure of approximately $73billionn, second only to South Africa on the entire African continent.

Given the size of the Nigerian economy and traditional spend of other African states, however, these figures mask a historical underspend in gross fixed capital formation (GFCF), a category that includes infrastructure projects and land improvements. An average GFCF of 30% of GDP is considered optimal for creating a growth-conducive environment, but in recent years Nigeria has spent just 11.9% of GDP compared to a sub-Saharan Africa average of 21.5%. Ethiopia, the continental leader, spent an average of 32.8% of its GDP on infrastructure over the last decade.

.png)