Entrepreneurs’ role in bolstering Africa-GCC economic ties

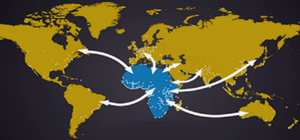

Dubai, UAE – The Dubai Chamber of Commerce and Industry’s efforts in backing small and medium enterprises in Africa have led to further Gulf Cooperation Council (GCC) investment in the continent, concluded the Economist Intelligence Unit (EIU) report, “New Horizons: Next generation Africa-GCC business ties in a digital economy”.

Sponsored by the Dubai Chamber and launched in preparation for the 4th Global Business Forum on Africa “Next Generation Africa”, the report investigates the prospects of building relationships between young entrepreneurs and investors in Africa and the GCC in order to determine the challenges to overcome, as well as the future opportunities to benefit from.

The report reveals that the UAE and Saudi Arabia were the second ($11billion) and fifth ($3.8billion) largest investing countries, respectively, in Africa by capital investment in 2016, according to fDI Intelligence, a division of The Financial Times. This serves as a great indicator to the future of economic ties between the GCC and Africa. The study also explores the approach to entrepreneurship and investment, delving deeper into sectors of interest such as retail, financial services and renewable energy. Hamad Buamim, President and CEO of the Dubai Chamber of Commerce and Industry, noted that Africa and the GCC are witnessing this rise of a need breed of entrepreneurs who are addressing regional challenges and charting a new course to drive economic growth and development on the continent.

The report reveals that the UAE and Saudi Arabia were the second ($11billion) and fifth ($3.8billion) largest investing countries, respectively, in Africa by capital investment in 2016, according to fDI Intelligence, a division of The Financial Times. This serves as a great indicator to the future of economic ties between the GCC and Africa. The study also explores the approach to entrepreneurship and investment, delving deeper into sectors of interest such as retail, financial services and renewable energy. Hamad Buamim, President and CEO of the Dubai Chamber of Commerce and Industry, noted that Africa and the GCC are witnessing this rise of a need breed of entrepreneurs who are addressing regional challenges and charting a new course to drive economic growth and development on the continent.

“Dubai is well-positioned to serve as a gateway for African companies that are looking for growth opportunities and easy access to expand their footprint in the GCC, Asia, and Europe. Dubai Startup Hub, an initiative of Dubai Chamber, is an ideal platform to assist innovative startups and SMEs from Dubai and around the world, including African entrepreneurs who are keen to collaborate and explore new business prospects,” Buamim added.

Moreover, the study indicates that there is room for growing business ties between the two regions; Africa has proven consistently resilient and aspirational with the younger generation catalysing an entrepreneurship revolution across the continent, expanding the demand for consumer goods, technology and services in the process.

Young businesspeople in GCC countries, on the other hand, are continuously seeking investment opportunities beyond the Middle East. As GCC start-ups mature, entrepreneurs and investors are starting to see the value of business links and expansion to Sub-Saharan Africa.

Additionally, young business leaders in the GCC and Sub-Saharan Africa both want flexibility and freedom in how they work; entrepreneurship is an increasingly attractive career for millennials. During a study of nine African countries, only two showed a dip below 25% in the number of youth engaged in some form of entrepreneurial activity. Even employed millennials exhibited an entrepreneurial streak and strived to do business differently, eschewing hierarchy, and favouring flexibility and empowerment.

Furthermore, the report discovered that growing self-confidence boosts the potential for home-grown solutions and south-south collaboration. Young business leaders in Africa and the GCC no longer only look to the West for inspiration and brands to import. Increased access to the latest technologies enables them to develop products and services that meet the needs of the local and regional markets.

On the same note, the study reveals significant room for growth for Africa-GCC business links. Africa remains, on the whole, the third phase of growth after the Middle East and Asia for GCC-based companies. Gulf private equity investment in Africa is likewise a niche activity, dominated by a handful of funds. However, awareness around the massive potential of an Africa-Gulf cooperation is on the rise, experts claim. As private capital from Europe and North America into Africa has consistently sought to exit the continent over the past decade, more opportunities open up for Gulf investors.

On the same note, the study reveals significant room for growth for Africa-GCC business links. Africa remains, on the whole, the third phase of growth after the Middle East and Asia for GCC-based companies. Gulf private equity investment in Africa is likewise a niche activity, dominated by a handful of funds. However, awareness around the massive potential of an Africa-Gulf cooperation is on the rise, experts claim. As private capital from Europe and North America into Africa has consistently sought to exit the continent over the past decade, more opportunities open up for Gulf investors.

Elsewhere, the report indicates that consumers are powering the growth of several sectors in Africa. With consumer spending forecast to reach $1.4 trillion annually by 2020, long-term consumption trends make Africa an enticing prospect for young business leaders. The continent’s emergent middle-class is the key driver behind interest in sectors such as retail (particularly, e-commerce), financial services, healthcare and education.

Technology is now a primary gateway to get goods and services into new hands. The room for growth is vast: e-commerce accounted for just 1% of overall retail in South Africa last year. Financial technology (fintech) is another promising sector poised to boost the fortunes of the continent’s small businesses.

Lastly, the report found that African entrepreneurs are turning to the GCC for more than just capital. While the region was largely viewed as a source of capital for African start-ups, Gulf investors and businesses have a lot more to offer by way of knowledge-sharing on operational and legal strategies. The Gulf is also increasingly becoming a destination for African products and services, particularly in the retail and food sectors.

In conclusion, the report suggests that the shift in the economic landscape in Africa and the GCC reflects the evolution of the next generation of business leaders. The growth of the middle class has driven a demand for consumer-focused products and services in a diverse set of sectors including retail, food, finance, education, healthcare and energy. This creates a host of new opportunities for regional investors, particularly from the GCC.

.png)