Ethiopia's Automotive Industry

Ethiopia is among Africa’s most impressive growth performers over the past decade averaging 10.9% annual growth between 2010 and 2020. With a GDP of US$91 billion in 2019 it is among the top ten largest economies in Africa and the third largest in Eastern Africa.

After Nigeria, the country is also home to the continent’s second largest population of 95 million people. Undoubtedly, Ethiopia is a relatively untapped investment opportunity in Eastern Africa especially in the manufacturing sector.

Ethiopia’s automotive market is dominated by second-hand imported vehicles – particularly commercial vehicles. Commercial vehicles were Ethiopia’s second most valuable import overall in 2019, worth US$955 million. On the other hand, commercial vehicles are also Ethiopia’s highest earning automotive export.

Ethiopia’s automotive market is dominated by second-hand imported vehicles – particularly commercial vehicles. Commercial vehicles were Ethiopia’s second most valuable import overall in 2019, worth US$955 million. On the other hand, commercial vehicles are also Ethiopia’s highest earning automotive export.

This can largely be attributed to Bishoftu Automotive Industry (BAI), an automotive manufacturing and assembly company run by the Ethiopian military. BAI specialises in assembling, upgrading, overhauling and localising buses, pick-ups, SUVs, trucks and military equipment such as tanks and armoured personnel carriers (APCs). Military vehicles are largely for the use of the Ethiopian military and African Union peacekeeping missions while civilian vehicles are supplied to local customers such as state-owned transport providers. Small quantities of commercial vehicles have been exported to neighbouring Somaliland.

Increasing Numbers

Ethiopia has the lowest motorisation rate globally, with only two cars per 1,000 inhabitants. Recent reports estimate that in 2019 there were 175,000 vehicles in use in Ethiopia, of which 100,000 were passenger vehicles and 65,000 were commercial vehicles. Between 2010 and 2020, total vehicles in use grew at a CAGR of almost 2.1%. According to Ethiopia’s Ministry of Transport approximately 84% of the market is passenger vehicles while commercial vehicles make up 16%.

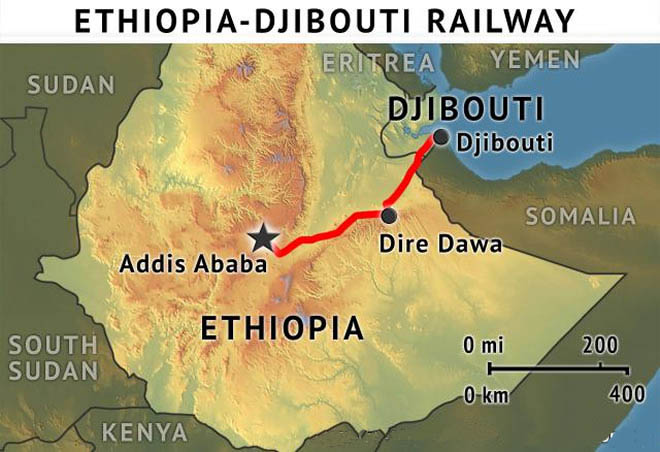

Second-hand vehicles in Ethiopia tend to appreciate in value due to high import duties and limited supply of vehicles. As a result, second-hand vehicles dominate the market. Approximately 85% of vehicles are second-hand imports, of which almost 90% are Toyotas.These vehicles are imported primarily from the Gulf States, through the Port of Djibouti.

Automotive Sales

Although there is almost no publicly available reliable data on vehicle sales in Ethiopia. It is however estimated that 18,000 vehicles are brought into Ethiopia each year. The majority of these are second-hand vehicles. Each year, 2,000 new Toyotas and between 5,000 and 7,000 used Toyotas are imported. Clearly, Toyota controls approximately 65% of the total market (new and second-hand) due to its reputation as being reliable and inexpensive to maintain.

The main drivers of new commercial vehicle sales are construction, agri-business and retail while passenger vehicle sales are driven by government (including diplomatic corps) purchases.

The main drivers of new commercial vehicle sales are construction, agri-business and retail while passenger vehicle sales are driven by government (including diplomatic corps) purchases.

Vehicle affordability is further locked up by prohibitively high vehicle taxes of sometimes more than 220% depending on engine size. As taxes in Ethiopia are cumulative, excise tax is calculated on the customs duty, surtax is charged on top of the excise tax, and customs duty and final VAT is calculated once the surtax, excise tax and customs duty have been added. Imported vehicles may cost as much as three times the retail price of the vehicle outside of the country.

Commercial vehicles, such as pick-ups, vans and trucks, have a lower tax rate than vehicles for personal use. Relative disincentives exist vis-à-vis personal vehicles compared to commercial vehicles. Diplomats and foreign investors are allowed to import vehicles duty-free. The supply-depressing character of foreign exchange shortages contributes to imbalances in the market and drives up the market price of vehicles, thus also having a negative impact on the affordability of vehicles in the Ethiopian market.

Production and Assembly

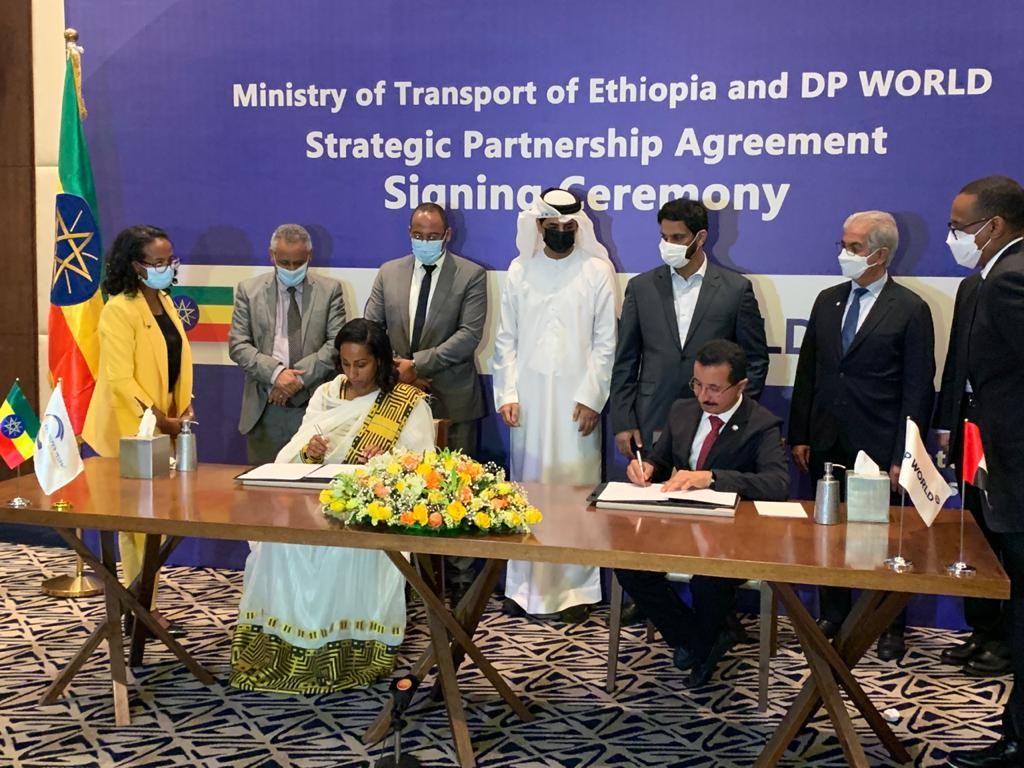

The Ethiopian Investment Commission (EIC) reports that 31 foreign vehicle investment projects (largely Chinese projects but also someinvolvement of European companies) and 73 domestic vehicle assembly investment projects have been licensed since 1998. This means that a total of 104 companies have been licensed for vehicle assembly in the country over the past two decades. However, only a few of these are operational, with the vast majority licensed at the pre-implementation stage.

During the past decade, a number of leading international automotive companies have carried out market scoping exercises to assess the viability of Ethiopia as an assembly hub. However, due to the limited market size, large-scale investments by these automotive firms have not yet materialised.

During the past decade, a number of leading international automotive companies have carried out market scoping exercises to assess the viability of Ethiopia as an assembly hub. However, due to the limited market size, large-scale investments by these automotive firms have not yet materialised.

Although a number of assemblers source some components such as tyres locally, Ethiopia has no defined local content requirement. A number of assemblers indicated that they are instructed that local content should be approximately 30% in order to qualify for the 30% tax incentive associated with all local manufacturing, but that no written agreement exists between assemblers and the state.

Due to Ethiopia’s tax system, which subjects vehicles to tax depending on their engine size rather than age or origin, it is often cheaper to import a second-hand vehicle with a smaller engine size than it is to assemble a vehicle locally, despite import taxes on these vehicles.

Despite being home to the continent’s second largest population, the overall automotive market size remains small in the short to medium term for current and prospective assemblers and producers. However, Ethiopia’s strong government support for industrialisation and the development of auxiliary industries coupled with a large cost competitive labour pool, and sizeable investments in infrastructure (both physical and economic) could position the country favourably for automotive manufacturing in the long term to service both the regional and domestic market with price competitive vehicles. To achieve this, clear definitions of local content need to be developed.

The country’s high tax rates on vehicles reduce the affordability of vehicles, especially given the low income of the population, and restrains the vehicle retail market. To address this, industry stakeholders should support the establishment of vehicle financing solutions, in order to encourage wider vehicle ownership. Taxes should be revised to also take the age of vehicles into account in order to provide incentives for locally produced vehicles.

.png)