The Market for Automotive Batteries in Africa

As Africa’s automotive market opens new opportunities for international companies, the demand for automotive batteries in Africa is expected to grow exponentially in the coming years.

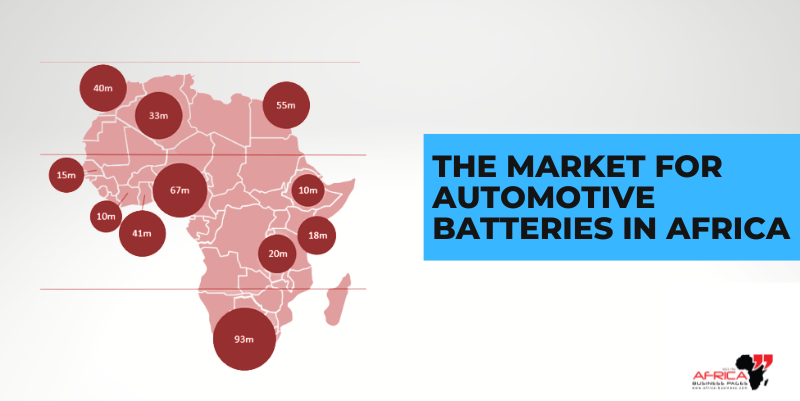

Africa automotive battery market is valued at roughly $ 2.3 billion in 2023 and is expected to grow at more than 5% per annum for the next five years. Factors responsible for this drastic increase in demand for automotive batteries in Africa can be attributed to the increasing use of two-wheelers and three-wheelers in African cities, easy availability of car financing and growth of an affluent middle class in Africa with increasingly disposable incomes.

In the African continent, South Africa is the largest single market for automotive batteries valued at roughly US$60 million per annum. However, sub-Saharan Africa (SSA) consumes automotive batteries worth US$94 million per annum and is fast emerging as an attractive market for international suppliers.

Leading suppliers of automotive batteries to African markets are France, Spain, China, Germany, Turkey, and Korea. In recent years, local automotive battery manufacturers in Kenya and South Africa have also entered the fray.

Few of the major players operating in Africa automotive battery market include Asimco, Johnson Controls, First National Battery, SEBANG GLOBAL BATTERY, Assad Group, Federal-Mogul Motorparts LLC, Dixon Batteries, Hyundai Sungwoo Solite Co., Ltd., MARIBAT, Chloride Exide Botswana Pty Ltd., and Robert Bosch (Pty) Ltd. – to name a few.

The automotive battery segment is likely to witness significant demand for the battery market in the Middle East and Africa region and is expected to be the leading end-user for lithium-ion batteries in the coming years. Moreover, expanding the 5th Generation based telecommunication network and implementation of Vision Documents in Saudi Arabia, UAE, Qatar, and Kuwait are likely to further aid the Middle East & South Africa battery market in the coming years.

It is noteworthy here that in the past decade, demand for rechargeable lithium-ion battery has been growing due to the increased usage of mobile phones, computer tablets, and laptops. Since demand from both electric vehicles and consumer electronics has been steadily growing, much of the recent focus of battery development has been on lithium-ion batteries.

Lithium-ion Batteries for African Markets

Lithium-ion batteries are a rechargeable batteries commonly used in electronic devices and energy vehicles. These batteries are also being used to store energy from renewable energy sources such as solar and wind.

The price of lithium-ion batteries declined steeply over the past ten years. In 2022, the cost of a lithium-ion battery was valued at approximately US$ 120 per kWh. This price has been falling continuously over the past 10 years and is expected to reach around USD 74/kWh by 2026, making it much more cost-competitive in the future.?

Due to its fast recharge, high energy density, and high discharge power, lithium-ion batteries are the only available technology capable of meeting OEM standards for car driving range and charging time. Because of their lower specific energy and heavier weight, lead-based traction batteries are not competitive in total hybrid electric vehicles or electric vehicles.

Lead Acid Battery for Hybrid Vehicles

As the world moves towards hybrid vehicles, demand for lead acid batteries for short power bursts, such as starting a car engine or running light electrical loads, is also on the increase. As new government incentives boost the more towards hybrid vehicles the production and demand for lead acid batteries is also expected to grow in the next few years.

In terms of product, the Africa lead acid battery market has been classified into flooded, sealed, AGM, and gel. The flooded segment dominated the Africa lead acid battery market with more than 65% share in 2022. The segment is expected to propel rapidly at a CAGR of 4% during the forecast period. The demand for flooded batteries is high due to their cost-effectiveness.

The flooded batteries are widely adopted, owing to their high backup power and their ability to operate when charged partially. Flooded batteries are preferred in grid energy storage and utility.

The flooded battery segment is estimated to augment two times faster than the absorbent glass mat (AGM) battery segment by the end of 2031, owing to an increase in the use of flooded batteries as commercial and residential backup batteries. On the other hand, manufacturers are diversifying their production for valve regulated lead acid battery types which are being publicized for their reverse power design since the electrolyte is captive, preventing it from spilling even when the case is punctured.

Lead Acid Battery Market in Africa

Based on country, the lead acid battery market in Africa has been segregated into Nigeria, Ethiopia, Egypt, South Africa, Kenya, Uganda, Algeria, and Ghana.

South Africa accounted for a relatively large share of the lead acid battery market in Africa, in terms of revenue. Building & construction is a rapidly growing sector due to an increase in population in the country.

Infrastructure development projects, booming industrialization, and construction activities are expected to be on the higher side in the country, which, in turn, is expected to supplement the demand for lead acid batteries for activities, such as backup, lighting & power tools.

Furthermore, the Government of South Africa is focusing on investment in electric car makers to launch more electric vehicles. Enactment of regulations and carbon emission policies also boosts the lead acid battery market. All the above factors indicate why South Africa is a leading country of the lead acid battery market in Africa.

Lead Acid Battery Market in Africa

The demand analysis of Africa lead acid battery market indicates toward investment in research & development (R&D) activities to produce advanced, high-performance, and corrosion-free lead acid batteries. Furthermore, companies should increase awareness about the advantages of lead acid batteries, such as robust performance during sudden outages & power surges and low maintenance cost of batteries, in order to compensate for its high initial investment cost.

Stakeholders operating in the Africa lead acid battery market are increasing the availability of different 12v lead acid battery types such as gel batteries that are eliminating the need for regular maintenance and help to prevent fluid leakage.

COVID-19 Impact

In the Middle East and Africa, the ongoing pandemic has drastically altered the status of the electronics sector and negatively impacted the growth of the battery market. The operations of several industries, such as electronics, automotive, and power, have been impacted by the pandemic, which has impacted the delivery cycle and increased import-export tariffs of batteries. The market has been impacted by the disruption in operational efficiencies and disruptions in the value chains attributable to the sudden closure of national and international borders.

Disruptions in terms of sourcing of raw materials from suppliers and temporary closure of manufacturing bases due to lockdowns and quarantines have impacted the growth of the market during the pandemic. However, as economies are planning to revive their operations, the demand for batteries is expected to rise in the Middle East and Africa. The expanding demand for batteries across automotive, industrial, household, consumer electronics, and other industries, along with significant investment by prominent manufacturers, is expected to drive the growth of the battery market.