Uganda's Automotive Spare Parts Market

Uganda's automotive spare parts market is undergoing significant transformation, driven by a combination of rising vehicle ownership, strategic local manufacturing initiatives, and the gradual digitization of parts distribution.

According to a recent study conducted by the research team of Africa Business Pages, Uganda has over 2.3 million registered vehicles which has helped create a robust demand base for aftermarket spare parts. As a result, the automotive spare parts sector in Uganda has attracted both established importers and innovative domestic manufacturers.

Market Overview: Demand Dynamics and Import Infrastructure

According to the study, Uganda's automotive sector is characterized by a high prevalence of used vehicles, predominantly imported from Japan, South Korea, UAE and Europe. This reliance on aging fleets – averaging 10-15 years in operational lifespan – creates sustained demand for replacement components, particularly brake parts, engine parts, batteries, filters, suspension systems, and electrical components.

Mandela Auto Spares, one of Uganda's largest parts stockists, maintains over 12,000 SKUs specifically tailored for Japanese models like Toyota, Mitsubishi, and Isuzu, reflecting market alignment with prevalent vehicle makes. Annual parts consumption is estimated at $8 billion continentally, with Uganda contributing a growing share amid its 11% year-on-year demand growth.

Import Infrastructure and Regional Trade Networks

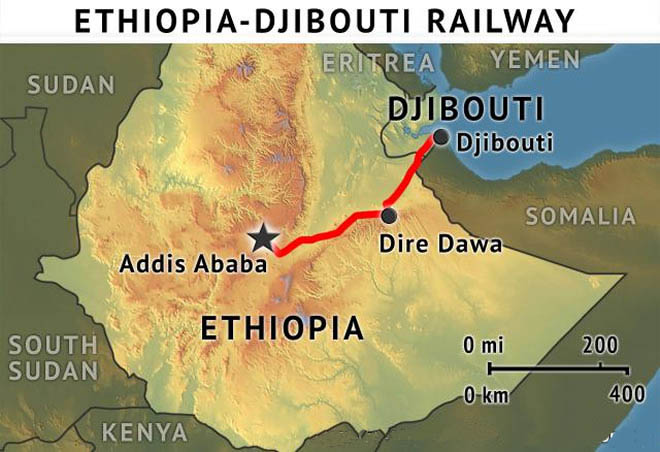

As the East African Community's leading auto parts importer, Uganda accounts for 37% of regional shipments, with 4,364 annual import transactions. Key trade corridors include:

- India: 1,971 shipments, specializing in lead molds and electrical components

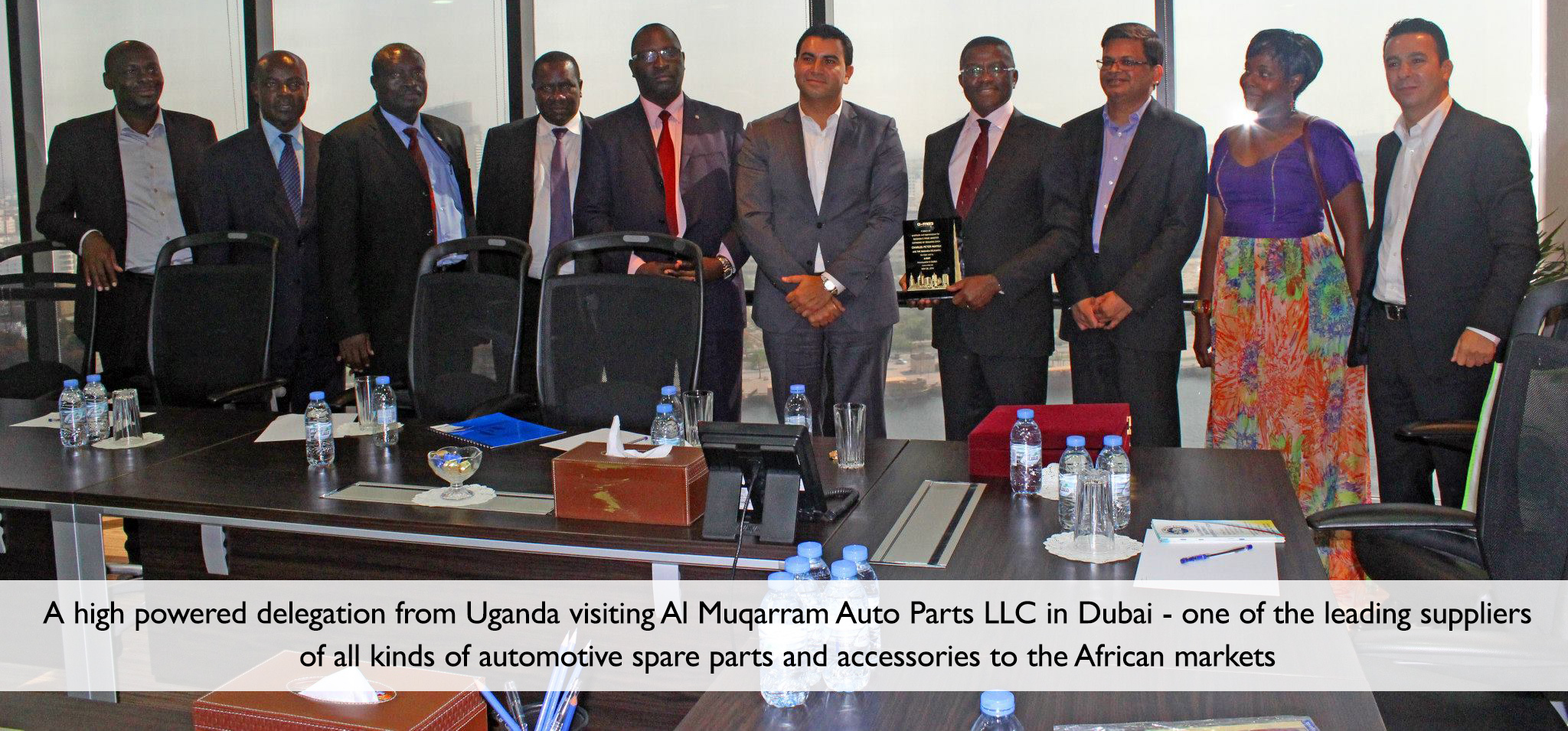

- United Arab Emirates: 1,045 shipments, focused on assorted spare parts

- China: 1,045 shipments, supplying engine and chassis components

This import ecosystem remains critical due to limitations in local production capacity. However, rising freight costs and supply chain disruptions post-2020 have incentivized shifts toward domestic manufacturing, as seen in Standard Waves Ltd's expansion from 1 workshop to 4 production facilities since 2016.

Uganda: The Hub for Re-Exports in East Africa

Ugandan importers, wholesalers and distributors increasingly act as re-export hubs for landlocked neighbouring countries in East Africa. A 2024 survey found 37% of UAE goods imported via Kampala were onward-shipped to Kigali and Juba, leveraging Uganda’s COMESA-certified warehousing zones. This secondary trade generated $96 million in logistics revenue for Ugandan firms, incentivizing further imports from the UAE.

Standard Waves Ltd: A Case Study in Import Substitution

Founded in 2016, Standard Waves Ltd (SWA) exemplifies Uganda’s nascent manufacturing push, producing 1,000+ replacement parts for 80 vehicle models. Their product range spans oil filters, engine mounts, and specialized fasteners, capturing 20% of the domestic market through competitive pricing – 30–40% below imported equivalents.

Strategic government backing, including tax incentives and land allocations for factory expansion, underscores policy alignment with the National Development Plan III’s industrialization targets. Hon. Evelyn Anite’s endorsement during SWA’s facility tour highlighted state priorities: “Local manufacturing isn’t optional; it’s essential for job creation and forex preservation.”

Brick-and-Mortar and Service Integration

Mandela Auto Spares’ B2B model – supplying government ministries, UN agencies, and 60+ garages – demonstrates the enduring relevance of physical distribution. Their value-added services, including direct-to-garage parts delivery with labor-only billing, reduce counterfeit risks and improve fleet maintenance outcomes for institutional clients. Kampala hosts 114 registered spare parts distributors, though market fragmentation persists, with 80% operating single-outlet models.

eCommerce Acceleration and Market Democratization

The vehicle parts eCommerce sector, projected to reach $1.9 million by 2025, is reshaping rural access. Platforms like Volza.com facilitate SME imports through consolidated shipping, while SWA’s digital catalog – accessed by 40% of its customers – enables just-in-time ordering for mechanics outside Kampala. However, logistical bottlenecks limit same-day delivery to major hubs, with 72-hour lead times common in Northern and Eastern Uganda.

Tax Regimes and Their Market Impacts

Uganda’s automotive policies present a dual-edged sword:

- Import Duty Waivers: Reduced tariffs on machinery imports (from 10% to 7%) aided SWA’s expansion.

- Excise Taxes: 20% levies on imported parts sustain price gaps favoring local manufacturers.

The 2023 Automotive Industry Development Bill proposes further incentives, including VAT exemptions for locally produced parts exceeding 60% domestic content.

Market Growth Trajectories

The Middle East and Africa spare parts market, valued at $13.36 billion in 2024, expects 5.9% CAGR through 2031, with Uganda outperforming at 7–8% driven by:

- Vehicle Electrification: Emerging demand for hybrid battery components and charging parts.

- Aftermarket Expansion: 45% of vehicles aged 15+ years require frequent part replacements.

Uganda’s automotive parts market stands at an inflection point, balancing import reliance with nascent industrialization.

With strategic public-private synergies, Uganda could capture 15-20% of the regional aftermarket by 2030, translating to $2.2 billion in annual revenue. The sector’s growth will increasingly hinge on technology adoption, quality enforcement, and workforce upskilling – a roadmap requiring coordinated investment and policy agility.