Kenyan Diaspora Remittances Help Kenya's Economy

Remittances from overseas workers helped the Kenyan economy tide over the devastating economic impact of Covid-19. Despite the negative impact on almost all major sectors, the Kenyan economy was able to tide over the financial impacts of the global pandemic due to regular inflow of foreign currency from overseas workers that form the diaspora.

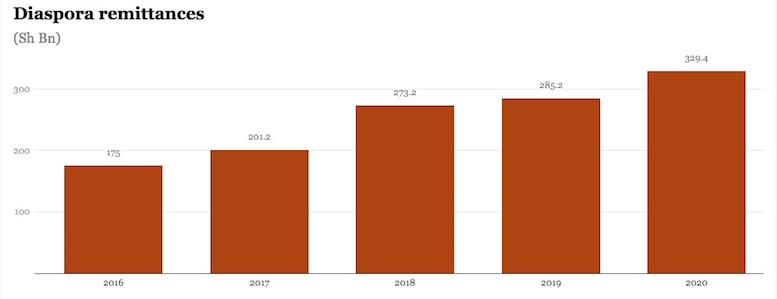

According to a recent report by Kenya’s Central Bank (CBK), diaspora remittances hit Sh329.41 billion ($3.094 billion) in 2020 despite the impact of the COVID-19 (coronavirus) pandemic. Although the pandemic crippled Kenya’s foreign earnings from tourism and exports due to a global lockdown, the East African nation earned a minimum of Sh6.33 billion weekly in diaspora remittance in 2020.

Kenya has been ranked 3rd in Africa in terms of diaspora remittance inflows

Nigeria is placed at the top as largest recipient of remittances in Africa, with projected inflows of US $ 21.7 billion in 2020. It is followed by Ghana. Senegal is placed in fourth place, behind Kenya, with projected inflows of US$ 2.3 billion at the end of 2020.

South Sudan has reported the Sub Sahara region’s highest share of remittances to GDP, at more than 35.4 per cent, followed by Lesotho (20.6 per cent), the Gambia (14.9percent), then Cape Verde (12.0 per cent), and Comoros (10.8 per cent).

According to a report, Kenya experienced a growth of 10.7 percent in diaspora remittance from the Sh285.23 billion ($2.796 billion) it made in 2019. It is also important to note that the pandemic significantly encouraged the use of financial technologies which accounted for an increase in online transfers. These smart innovations helped Kenyan’s abroad to send money home with ease.

Diaspora remittances have been Kenya’s largest source of foreign exchange since 2015 when they overtook earnings from tea exports. Other key sources of foreign exchange include tourism receipts as well as horticulture and coffee exports.

“This remarkable growth of remittances has been supported by financial innovations that provided Kenyans in the diaspora more convenient channels for their transactions,” Patrick Njoroge, CBK’s Governor said in a statement,

According to the apex bank, the strong performance came on the back of December 2020 remittances hitting Sh32.91 billion ($299 million). That was the all-time high to have ever been sent home in a single month.

The country currently tops in diaspora remittances in the Eastern African region. According to the report, the United Nations recommended that remittance costs should not exceed three percent of the value of money being sent home, but steady growth in remittance has defied that submission.

For over a decade, Kenya’s economy did not experience a severe contraction like it did in the second quarter of 2020. But the impact of the COVID-19 pandemic reversed the narrative after 12 years as it crippled key economic sectors like tourism and agriculture. According to a report, the country’s Gross domestic product (GDP) depreciated by 5.7 percent, compared with growth of 4.9 percent in the three months between March and June.

Diaspora Remittances for Kenya’s Development

As the country closes in on its Kenya Vision 2030, the government is relying heavily on its expat population for investment. The development program focuses on matters like curbing the high cost of remittances, addressing diaspora issues, using mobile money to boost tourism, reversing brain drain, and creating a comprehensive data file on Kenyan diaspora profiles.

Money sent back to Kenya is steering the economy to drive investment in different core sectors such as financial services, BPO, tourism, and education. The emergence of mobile technology is reducing the cost of international transfers by offering a safer and more comfortable approach. The Kenyan government is taking proactive steps to streamline the process. It is also taking steps to offer tax rebates and offer incentives on investments made by expats.

Remittances, if utilised wisely, have the potential to radically transform a country’s economy and Kenya is well aware about this fact. Despite being a relatively low-income country, appropriate utilisation of remittance money has shown a huge potential for growth to other nations. With a growing sense of confidence in the country’s investment landscape, the coming years could see a further rise in inward remittances. Remittances can be considered a significant contribution to a country’s GDP. This external financial source can help bail out developing nations in times of distress and shape a future that’s characterised by sustainable development.