The Pharmaceutical Industry in Kenya: Importers in Kenya

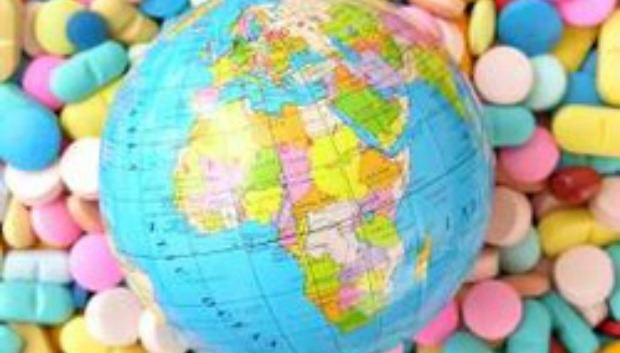

The pharmaceutical industry in Kenya is growing at a rapid pace and offers excellent opportunities for exporters and manufacturers to establish their products and services in the lucrative market for pharmaceuticals in East Africa. Kenya is currently the largest producer of pharmaceutical products in the Common Market for Eastern and Southern Africa (COMESA) region, supplying about 50% of the regions’ market.

Kenya’s prescription pharmaceuticals market is worth over $500 million and is expected to grow at a compound annual growth rate (CAGR) of 11.8% till 2020. Prescription drugs account for around 78% of the market. However, the fastest growth in the coming years is expected in the over-the-counter (OTC) product sales.

The pharmaceutical industry in Kenya consists of three segments namely the manufacturers, distributors and retailers. All these play a major role in supporting the country’s health sector, which is estimated to have about 5,000 health facilities countrywide.

The number of companies engaged in manufacturing and distributionof pharmaceutical products in Kenya continue to expand, driven by the Government’s efforts to promote local and foreign investment in the sector. There are about 700 registered wholesale and 1,300 retail dealers in Kenya, manned by registered pharmacists and pharmaceutical technologists. These pharmacies are accorded a 25% mark-up on retail drugs. The pharmaceutical sector in Kenya is also engaged in assembling capsules, disposable syringes, paracetamol, and surgical gauze amongst others.

The number of companies engaged in manufacturing and distributionof pharmaceutical products in Kenya continue to expand, driven by the Government’s efforts to promote local and foreign investment in the sector. There are about 700 registered wholesale and 1,300 retail dealers in Kenya, manned by registered pharmacists and pharmaceutical technologists. These pharmacies are accorded a 25% mark-up on retail drugs. The pharmaceutical sector in Kenya is also engaged in assembling capsules, disposable syringes, paracetamol, and surgical gauze amongst others.

Kenya spends about 8% of its GDP on health. The Kenya Medical Suppliers Agency (KEMSA), a division of the Ministry of Health, largely carries out the distribution of pharmaceutical products in Kenya. It distributes drugs to government public health facilities and private health facilities.

The health sector in Kenya is one of the sectors that has experienced remarkable development in the recent years. The country has made great efforts in controlling diseases like Malaria, TB and Cholera while actively fighting the AIDS/HIV pandemic. Similar efforts have been made in controlling communicable diseases like

poliomyelitis, neonatal tetanus and measles. The targets for eradication of the guinea worm disease and elimination of lymphatic filariasis and leprosy have been attained. Other parasitic diseases of epidemiological concern such as schistosomiasis, helminthiasis and leishmaniasis are seriously being addressed.

The market is heavily dependent on the private clientele, and affordability remains a primary restraint, together with low reimbursement rates. Kenya also enjoys preferential access to the regional market under a number of special access and duty reduction programmes related to the East African Community (EAC)

and the Common Market for Eastern and Southern Africa (COMESA) among others.

Increasingly, urban consumers constitute Kenya’s primary market segment, while private hospital pharmacies remain the principal vendors within the market’s urban sector.

Pharmaceutical Manufacturing Companies in Kenya:

- Alpha Medical Manufacturers – Nairobi

- Aventis Pasteur SA East Africa – Nairobi

- Bayer East Africa Limited – Nairobi

- Beta Healthcare (Shelys Pharmaceuticals) – Nairobi

- Cosmos Limited – Nairobi

- Dawa Pharmaceuticals Limited – Nairobi

- Didy Pharmaceutical – Nairobi

- Diversey Lever – Nairobi

- Eli-Lilly (Suisse) SA – Nairobi

- Elys Chemical Industries Ltd – Nairobi

- Glaxo SmithKline – Nairobi

- High Chem East Africa Ltd – Nairobi

- Ivee Aqua EPZ Limited – Athi River

- Mac’s Pharmaceutical Ltd – Nairobi

- Manhar Brothers (Kenya) Ltd – Nairobi

- Novartis Rhone Poulenic Ltd – Nairobi

- Novelty Manufacturers Ltd – Nairobi

- Pfizer Corp (Agency) – Nairobi

- Pharmaceutical Manufacturing Co (K) Ltd – Nairobi

- Pharmaceutical Products Limited – Nairobi

- Phillips Pharmaceuticals Limited – Nairobi

- Regal Pharmaceutical Ltd – Nairobi

- Universal Pharmaceutical Limited – Nairobi

Cardiovascular, diabetes and anti-infectives constitute the largest and fastest-growing prescription market segments, and GlaxoSmithKline (GSK) is reported to be Kenya’s leading pharmaceutical supplier, with around 12% market share. This is primarily due to the fact that the company reduced the prices of key products by approximately 40% a few years back. Around 41% of all anti-infective products sold in pharmacies were licensed to GlaxoSmithKline.

GlaxoSmithKline has been able to garner a substantial share of Kenya’s pharmaceutical market largely due to the popularity of its anti-infectives, which account for approximately 42% of all revenues generated in the prescription sector. The prices of Amoxil (amoxicillin) 500mg, Suprapen (amoxicillin plus flucloxacillin) 500mg and Floxapen (flucloxacillin) 500mg are particularly competitive within the respective active ingredient classes

Cardiovascular is Kenya’s most dominant and fastest-growing prescription market segment, worth around $40 million in 2017 and expected to show a CAGR of 15.4% to 2019, while the diabetes market was valued at approximately $35.2 million last year and is forecast to rise at a CAGR of 13.5% during 2010-2019.

Based on revenue segmentation, the top-selling cardiovascular product in Kenya was Nebilit [nebivolol) 5mg, licensed to Menarini, accounting for approximately 7% of revenues for all prescription products sold.

And within the diabetes therapeutic segment, Merck Serono’s Glucophage (metformin) 500mg was the most popular product, based on volume segmentation, accounting for approximately 19.8% of all oral hypoglycaemic tablets sold.

Kenyan private consumers’ prefer branded innovator products, despite the high penetration of generic manufacturers within the overall industry. A critical success factor within the Kenyan market is the use of distributors with established networks with key vendor outlets.

Investment Opportunities in Kenya’s Pharmaceuticals Industry

Opportunities for investment in the health/pharmaceutical sector in Kenya include:

- ? Manufacture of disposable surgical gloves, latex gloves and condoms.

- Commercial processing of traditional medicines, considering the diverse

flora available in the country.

? - Multipurpose chemical plant for bulk production of intermediate inputs

such as paracetamol, aspirin, etc.

? - Processing of locally available sugar, salt (sodium chloride) and ethanol

to pharmaceutical grade for pharmaceutical industry use.

? - Chemical plant to manufacture anti tuberculosis, anti-leprosy, antibiotic

rifampicin from the penultimate state.

? - Manufacture of Quinine by extraction from Cinchona bark and

subsequent purification and synthesis to Quinine sulphate.

? - Extraction of Hecogenin from sisal waste and synthesis of Betamethasone from Hecogenin.

- Manufacture of medical supplies e.g. syringes, catheters, gauzes, etc,and medical equipment for the regional market.

- Prospects for the pharmaceutical industry in Kenya?

- Export of high quality products

?Increased quantity of production - Expand product portfolio and intensify the search for new markets and marketing opportunities

- Support for medical research Kenya’s Pharmaceutical Industry 15

- Ensure strict adherence to the national code of conduct and the industry’s code of practice.

Importers Database: Importers of Pharmaceuticals in Africa

The research team at Africa Business Pages has compiled a valuable database of pharmaceutical companies in Africa through painstaking work across more than 20 African countries. The result is the compilation of the first even Africa Pharmaceutical Directory which lists more than 6,500 pharmaceutical companies in Africa. This database of pharmaceutical-related companies in Africa lists wholesalers of pharmaceuticals in Africa, pharmacies in Africa, pharmaceutical retailers in Africa, hospital suppliers in Africa, Pharmaceuticals Distributors, Clinics & Hospitals, Government Medical Clinics, Medical Institutes as well Manufacturers of Pharmaceuticals in Africa.

The research team at Africa Business Pages has compiled a valuable database of pharmaceutical companies in Africa through painstaking work across more than 20 African countries. The result is the compilation of the first even Africa Pharmaceutical Directory which lists more than 6,500 pharmaceutical companies in Africa. This database of pharmaceutical-related companies in Africa lists wholesalers of pharmaceuticals in Africa, pharmacies in Africa, pharmaceutical retailers in Africa, hospital suppliers in Africa, Pharmaceuticals Distributors, Clinics & Hospitals, Government Medical Clinics, Medical Institutes as well Manufacturers of Pharmaceuticals in Africa.

The Africa Pharmaceutical Directory is available for download here.

Companies and exporters of pharmaceuticals from across the world have been using this database of pharmaceutical companies in Africa to reach potential buyers in Africa of pharmaceuticals and connect with importers of pharmaceuticals in Africa.

This Directory contains the latest and complete information about your potential business partners in several cities across Africa.

- Listings of Top Companies Dealing in Pharmaceuticals

- In MS Excel format

- Classified under different Trade Categories

- Up-to-date database of tyre dealers in Africa

The database is well organised in an Excel sheet and the sortable fields include: Company Name, Address, Phone, Fax, Email, Website, Business Category.