Africa's Booming Gold Trade

In another instance of the African awakening, efforts are now underway by several African governments to keep a stricter control on the African continent’s large gold deposits and mineral wealth. The aim is to to add value to African minerals before exporting them.

Over the years, many African countries have been exporting a wide variety of minerals and other natural resources to earn much needed foreign exchange to boost their economies. However, things are changing now as governments in Africa are now planning to add value to their natural resources before exporting them to overseas markets.

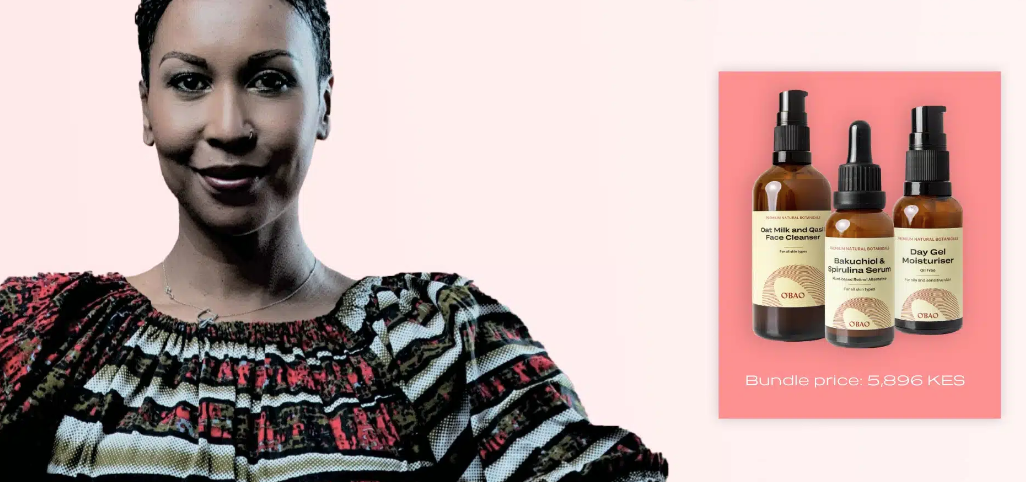

Rwanda, once again, has taken the lead by establishing its first-ever gold refinery. Located in Kigali Special Economic Zone in Gasabo District, the $5 million plant has a capacity to refine 6 tonnes of gold a month, or about about 220 kilogrammes a day. The refinery has capacity to process gold from around the African continent thereby eliminating the need to travel long distances to look for a place that can refine Africa’s gold.

Uganda and South Africa have also set up similar refineries to process gold mined in African countries. The DRC’s also opened its first refinery in Ituri Province in July 2019, and the second in South Kivu in March 2020.

“What we are doing is not new but people have been used to taking gold to Europe, Dubai, Turkey, Switzerland, and Belgium. Now we have the same factory with the standards as those in Europe and Asia,” said Jean de Dieu Mutunzi, chairman of Aldango, the company behind the initiative which is a joint venture between two firms – Hilly Metals Company, a local company, and Aldabra. The company’s core business is to buy gold and process it to 99.99 per cent purity.

Rwanda targets to collect $1.5 billion from mineral exports by 2024.

Rwanda’s Rising Gold Exports

Aldango is supporting the government to transform Rwanda into a precious metal manufacturing and trading hub across Africa. Most of the gold in Rwanda is mined from gold located in Miyove village, Gicumbi district, North, Karongi district, West and Nyamagabe district in Southern province.

Rwanda only recently entered the artisanal gold trade in a major way, taking advantage of the political chaos in neighbouring Burundi and enforcement actions in the DRC to capture the lion’s share of the South Kivu gold trade. The documented paucity of domestic gold production in Rwanda makes it clear that the vast majority of this gold found in Rwanda is not of Rwandan origin.

In 2014, Rwanda reported $8.1 million USD in exports of “other minerals,” which includes gold. This rose to $80.06 million USD in 2016. The same year, reporting by The National Institute of Statistics for Rwanda documents how “other unwrought gold (incl. gold plated with platinum), non-monetary” totaled $75.52 million USD in 2016.

According to the UN Group of Experts, Rwanda officially exported 2,163 kg of gold in 2018, yet 12,539 kg of gold imported into the UAE was reported as Rwandan in origin.

This swift surge in gold production has not gone unnoticed by the Rwandan government, which publicly celebrates its emergence as one of the region’s most significant gold exporters.

It is believed that South Kivu gold is being smuggled across the border to Rwanda, then laundered into the legitimate international supply chain through its export to Dubai as supposedly Rwandan gold.

Africa’s Gold Trade

Illicit gold trade in the Africa appears to be booming. Despite efforts to introduce traceability and due diligence for the artisanal gold supply chain, only a small fraction of gold is actually being captured through legal channels.

Some traders and exporters in Africa succeed in staying under the radar of government authorities by undervaluing their gold purchases and exports, declaring only a small percentage while pocketing massive profits—a percentage of which should have been paid in taxes.

Gold refineries in Africa will ensure that all private sector players are importing and exporting gold according to the regulatory procedures outlined by each country, with all taxes paid, and with an authentic ICGLR certificate.

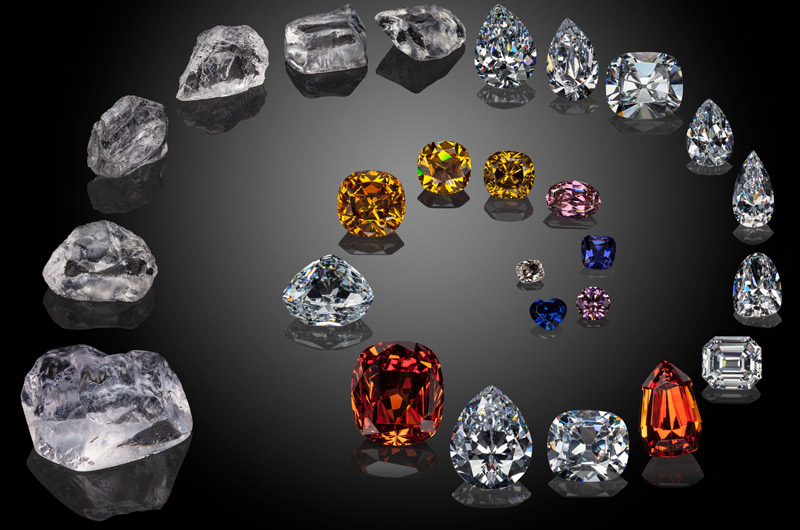

Mining to Market

After it’s mined, gold is sold by miners to a trader. There are two types of traders: those based at mine sites and smaller towns and those in the provincial capitals and larger cities.

Once a trader aggregates a sufficient amount of gold, they transport it to a city that has good transportation links leading outside of the country. The trader sells the gold to an exporter. Only a licensed exporter is allowed to sell gold to an international buyer.

The exporter most often buys from multiple traders and waits until they have aggregated enough gold to make it profitable to export. This calculation includes taxes and fees to pay on their shipment, time required for official (often onerous) export procedures, and the cost of transportation; gold is often carried by hand by a representative across borders.

The exporter transports the gold to a neighbouring Africa country where it is aggregated. The gold can be transported onward to an international destination where it is refined. Alternatively, it can be purchased by a locally-based refiner, as refiners with significant capacity are opening

in the Great Lakes region. The gold, whether refined or doré, then makes its way to a trading centre where it enters the international legal supply chain.

.png)